Trial Balance Report

The Trial Balance report is a crucial accounting tool that lists all the accounts in your general ledger along with their debit or credit balances. It serves as a checkpoint to ensure that the total of all debit balances equals the total of all credit balances, validating the mathematical accuracy of your bookkeeping.

Why is the Trial Balance report important?

Trial Balance vs. Other Financial Reports

While the Trial Balance is a key internal accounting tool, it differs from other financial reports:

-

The Trial Balance is a working document used to ensure accounting accuracy. It lists all accounts with their debit or credit balances but doesn't categorize them

-

The Balance Sheet organizes accounts into assets, liabilities, and equity, providing a snapshot of the company's financial position at a specific point in time

-

The Profit and Loss (P&L) report shows income and expenses over a period, demonstrating the company's profitability

Think of the Trial Balance as a behind-the-scenes check that helps create accurate Balance Sheets and P&L reports

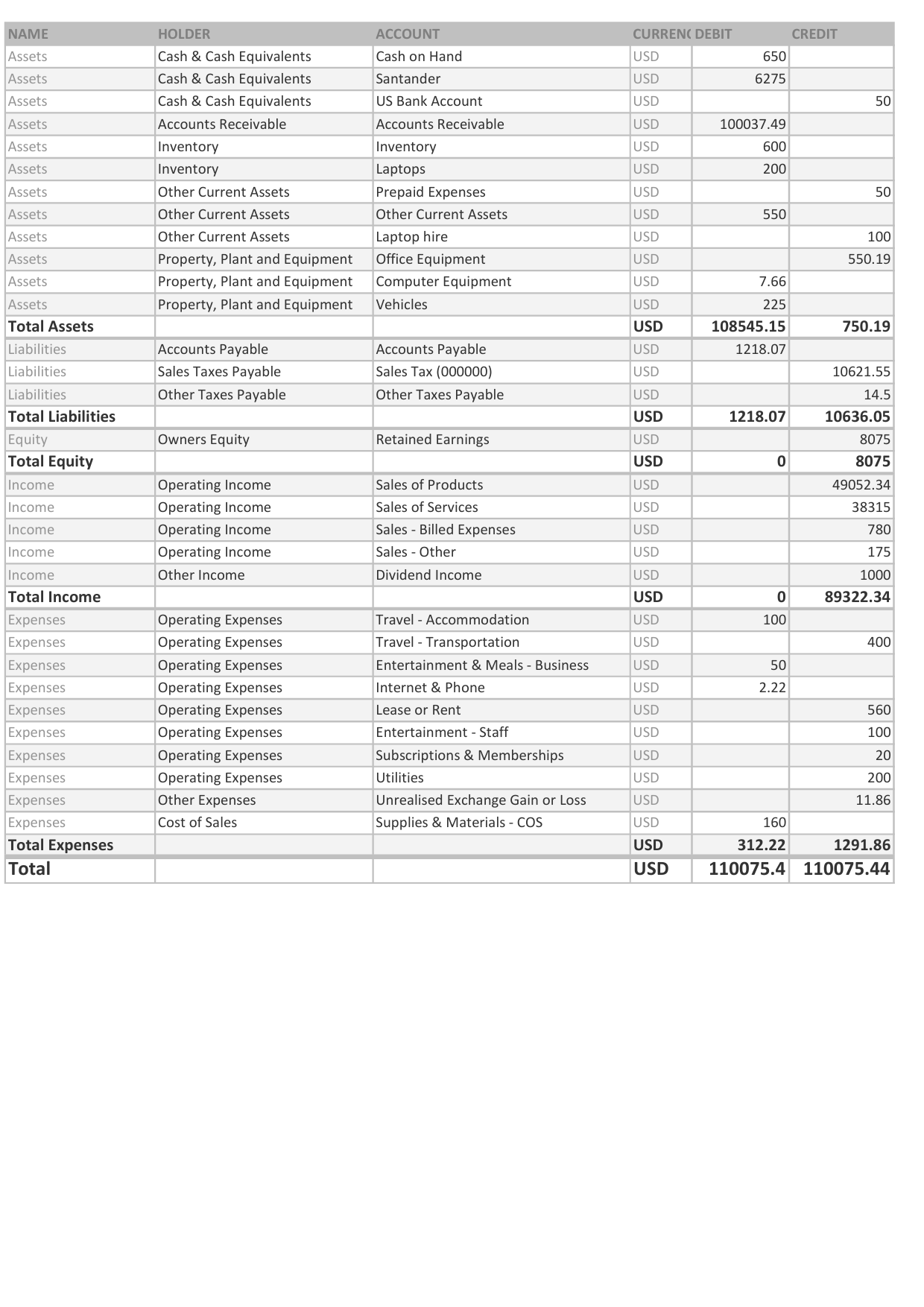

Key Components of the Trial Balance Report

Understanding the main elements of your Trial Balance can help you better analyze your business's financial records:

- Account names: A list of all accounts in your general ledger.

- Account numbers: The unique identifier for each account.

- Debit column: Shows the debit balance for each account.

- Credit column: Shows the credit balance for each account.

- Total: The sum of all debits and credits, which should be equal.

If the total debits don't equal the total credits, there's an error in your bookkeeping that needs to be identified and corrected.

Generating a Trial Balance Report in Fiskl

To create and customize your Trial Balance report in Fiskl:

- Go to

Accounting > Reportsfrom the left menu and select "Trial Balance" - Choose your desired date using the date selector

- Customize your report using the available options:

- Switch between Cash and Accrual accounting methods

- Hide empty accounts

- Divide large numbers by 1000 for easier reading

- Show or hide unrealized foreign exchange gains/losses

Cash vs. Accrual Accounting

Fiskl offers both Cash and Accrual accounting methods for your Trial Balance report:

- Cash: Shows account balances based on when cash is received or paid

- Accrual: Records account balances when transactions are earned or incurred, regardless of when cash changes hands

Which method should I use?

Analyzing your Trial Balance Report

To get the most out of your Trial Balance report:

- Check for balance: Ensure that the total debits equal the total credits

- Review account balances: Look for any unusual or unexpected balances

- Compare to previous periods: Identify significant changes in account balances over time

- Use as a basis for financial statements: The Trial Balance serves as a starting point for creating your Balance Sheet and P&L report

- Investigate discrepancies: If you notice any errors or imbalances, trace them back to the original transactions

Click on any amount in the report to see a list of related transactions, helping you investigate specific entries.

Exporting and Sharing your Trial Balance Report

Fiskl makes it easy to share your Trial Balance report:

-

Export to spreadsheet:

- Click the export button at the top right of the screen

- Choose between Google Sheets or Excel format

-

Create a PDF:

- Click the print button at the top right of the screen

- Save as PDF or print a physical copy

All exported reports include a date and time stamp, as well as the selected accounting method.

Adding Notes to Your Report

To provide context or explanations for your financial data:

- Click on the note icon at the top right of your screen

- Add your comments or explanations

- These notes will be included when you export or print the report

Examples

Example of Excel or Google Sheets export:

Remember, your Trial Balance report is a vital tool for ensuring the accuracy of your financial records. Regular review can help you maintain clean books, identify potential issues early, and provide a solid foundation for creating your other financial statements.