Balance Sheet

The Balance Sheet report is a crucial financial statement that provides a snapshot of your business's financial position at a specific point in time. It summarizes what your company owns (assets), what it owes (liabilities), and the owners' equity, giving you a clear picture of your business's financial health.

Why is the Balance Sheet report important?

Balance Sheet vs. Profit and Loss

While both the Balance Sheet and the Profit and Loss (P&L) report are vital financial statements, they serve different purposes:

-

The Balance Sheet provides a snapshot of your business's financial position at a specific point in time. It follows the fundamental accounting equation:

Assets = Liabilities + Equity. This equation must always balance, hence the name "Balance Sheet". -

The Profit and Loss report shows your business's financial performance over a period of time. It follows a sequential structure, starting with revenue and subtracting various costs and expenses to arrive at the net profit or loss.

Think of the Balance Sheet as a photograph of your financial status at a specific moment, while the P&L is more like a video of your business's financial journey over time.

Key components of the Balance Sheet report

Understanding the main sections of your Balance Sheet can help you better analyze your business's financial health:

-

Assets: What your business owns or controls. Assets are typically divided into:

- Current Assets (e.g., cash, accounts receivable, inventory)

- Long-Term Assets (e.g., property, equipment, investments)

-

Liabilities: What your business owes to others. Liabilities are typically divided into:

- Current Liabilities (e.g., accounts payable, short-term loans)

- Long-Term Liabilities (e.g., long-term loans, bonds payable)

-

Equity: The residual interest in the assets after deducting liabilities. It includes:

- Share Capital

- Retained Earnings

- Current Year Profit/Loss

Pay close attention to your Current Assets and Current Liabilities. The relationship between these figures (known as the Current Ratio) can help you assess your business's short-term financial health.

Generating a Balance Sheet report in Fiskl

To create and customize your Balance Sheet report in Fiskl:

- Go to

Accounting > Reportsfrom the left menu and select "Balance Sheet" - Choose your desired date using the date selector

- Customize your report using the available options:

- Compare periods

- Switch between Cash and Accrual accounting methods

- Hide empty accounts

- Divide large numbers by 1000 for easier reading

- Show or hide unrealized foreign exchange gains/losses

- Toggle between summary and detailed views

Comparing periods

Fiskl allows you to compare up to three different dates:

- Click on "Compare" after selecting your initial date

- Choose additional dates to compare

- View differences in both monetary and percentage values

This feature helps you track changes in your financial position over time and identify trends or anomalies.

Cash vs. Accrual accounting

Fiskl offers both Cash and Accrual accounting methods for your Balance Sheet report:

- Cash: Shows assets and liabilities based on when cash is received or paid

- Accrual: Records assets and liabilities when they're earned or incurred, regardless of when cash changes hands

Which method should I use?

Analyzing your Balance Sheet Report

To get the most out of your Balance Sheet report:

- Review regularly: Monthly or quarterly reviews can help you stay on top of your financial position

- Compare to previous periods: Look for trends in your assets, liabilities, and equity

- Calculate key ratios: Use figures from your Balance Sheet to calculate important financial ratios like the Current Ratio or Debt-to-Equity Ratio

- Investigate significant changes: If you notice large shifts in any category, dig deeper to understand why

- Use it alongside other reports: Combine insights from your Balance Sheet with those from your P&L and Cash Flow Statement for a comprehensive financial analysis

Click on any total in the detailed view to see all related transactions, helping you investigate specific entries.

Exporting and Sharing your Balance Sheet Report

Fiskl makes it easy to share your Balance Sheet report:

-

Export to spreadsheet:

- Click the export button at the top right of the screen

- Choose between Google Sheets or Excel format

-

Create a PDF:

- Click the print button at the top right of the screen

- Save as PDF or print a physical copy

All exported reports include a date and time stamp, as well as the selected accounting method.

Adding Notes to Your Report

To provide context or explanations for your financial data:

- Click on the note icon at the top right of your screen

- Add your comments or explanations

- These notes will be included when you export or print the report

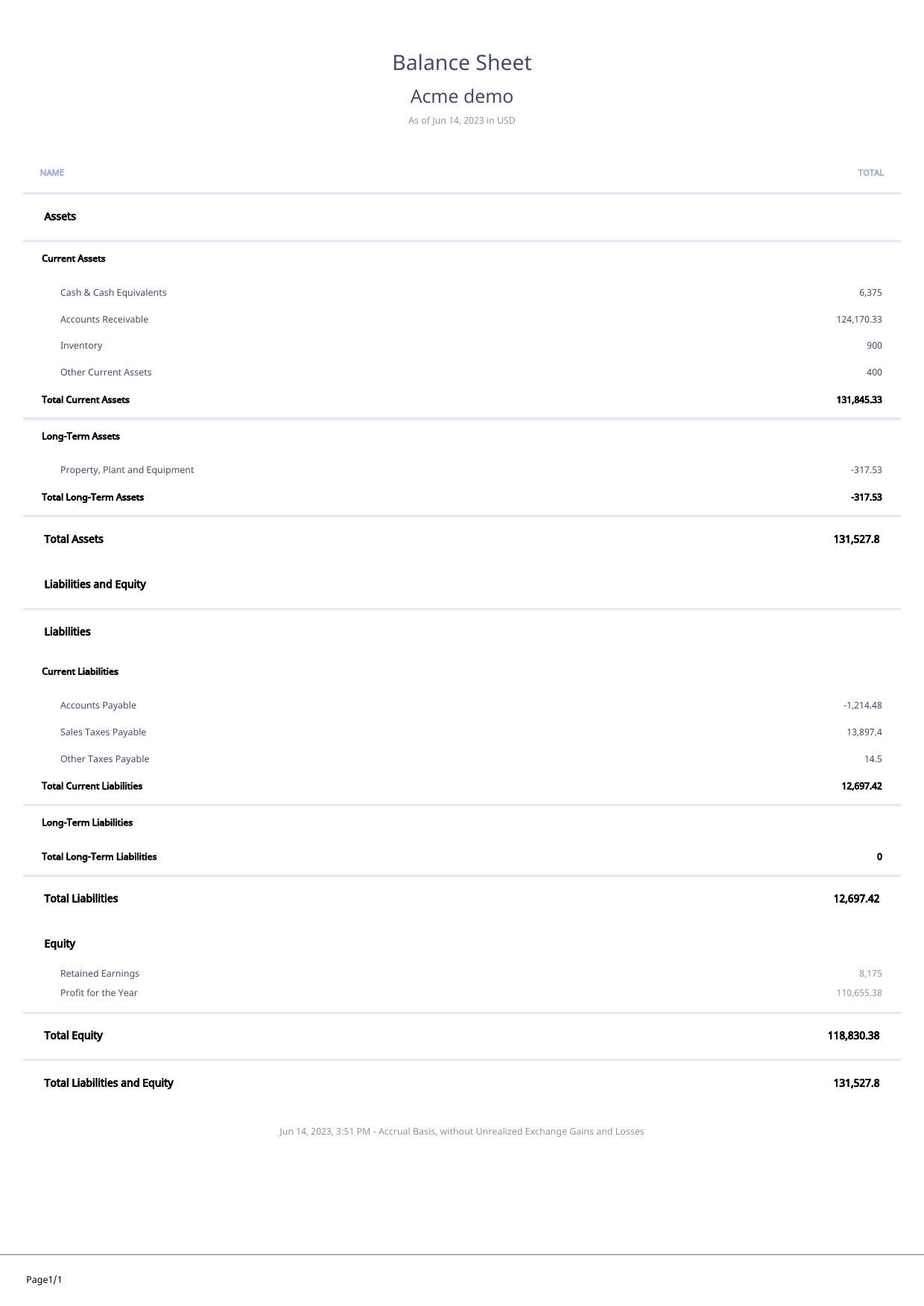

Example

Remember, your Balance Sheet report is a powerful tool for understanding your business's financial position. Regular review and analysis can help you make informed decisions about managing your assets, liabilities, and equity to ensure the long-term financial health of your business.