Understanding Journal Entries

Journal entries also referred to as Account transactions and are the foundation of your accounting system. Journal entries are the record of all financial transactions in your business. You can think of the Chart of Accounts as your folder structure and journal entries as the transactions within them.

How Fiskl handles Journal Entries

Fiskl is an intuitive double-entry accounting system built with the business owner in mind while ensuring accountants have a fully featured accounting platform to process their clients accounts.

Learn more about the journal entry capabilities

Types of Journal Entries

Fiskl supports several types of journal entries to cover all your accounting needs.

Learn more about the different types of journal entries

Creating and Managing Journal Entries

While Fiskl automates much of the process there are many reasons why you would need to manually create and edit journal entries.

- Business owner

- Accountant

As the business owner you would typically be adding journal entries directly to your accounts in Cash & Cash Equivalents and Credit Cards.

Journal entry guides

- See how to create a manual transaction

- See how to create a split transaction

- See how to create a matched transaction

- See how to create an Accounts Receivable transaction

- See how to create an Accounts Payable transaction

- See how to create an Opening Balance

As an accountant you can add journal entries as you would in any other accounting system. But in Fiskl, for transactions involving Cash & Cash Equivalents and Credit Cards you need to add them from these accounts.

For example if you were adding a Travel - Accommodation expense to Cash on Hand you would create this in Assets > Cash & Cash Equivalents > Cash on Hand and select the Travel - Accommodation category.

Alternatively, if there was an expense created in Fiskl you would match this expense from Assets > Cash & Cash Equivalents > Cash on Hand.

For making adjustments or for a more accountant familiar feel you can use the Multi journal entry which also supports multi-currency.

Journal entry guides

- Learn more about multi journal entries

- See how to create a manual transaction

- See how to create a split transaction

- See how to create a matched transaction

- See how to create an Accounts Receivable transaction

- See how to create an Accounts Payable transaction

- See how to create an opening balance

When adding or viewing a transaction we add a CR or DR under the category which has a very useful tool tip explaining which account is being credited and which is being debited. (e.g., Credits Bank Account and Debits "Cost of Goods Sold")

Viewing Journal Entries

You can view your transactions in their individual accounts. This is useful if you are viewing them with the intent of making adjustments.

For a bigger picture on your transactions you can use the Transactions by Account report.

Depending on your reason you can use the reports like Balance Sheet or Profit and Loss (P&L).

Setting the reports to detailed allows you to drill down to transaction level.

Remember, Fiskl's accounting reports draw directly from these journal entries, so keeping them accurate ensures your reports are always up-to-date and reliable.

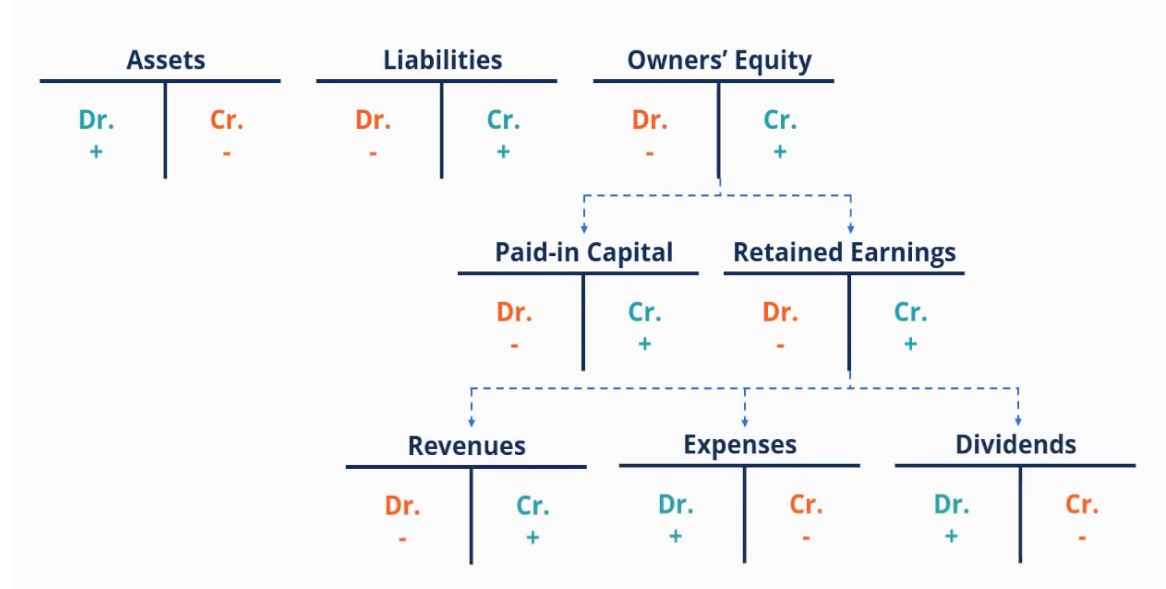

Cheat Sheet

Next Steps

Now that you understand the basics of journal entries in Fiskl, you might want to explore:

- Setting up your Chart of Accounts CoA transaction

- See how to create a manual journal entries

- See how to create split & match transaction

- See how to create an Accounts Receivable (AR) transaction

- See how to create an Accounts Payable (AP) transaction

- See how to create an Opening Balance transaction

- Learn more about multi journal entries used by accountants